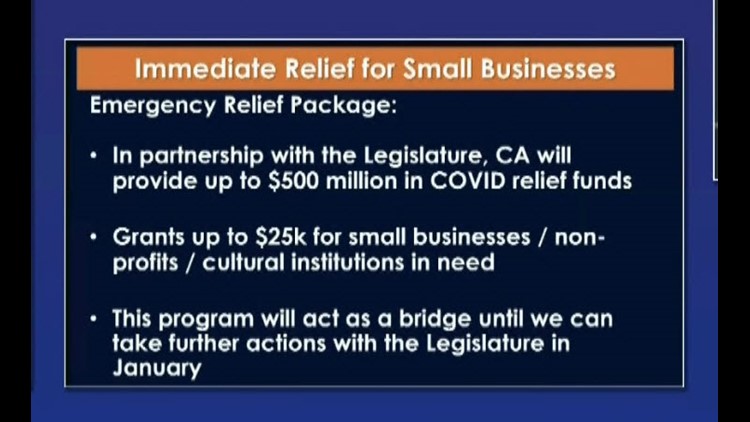

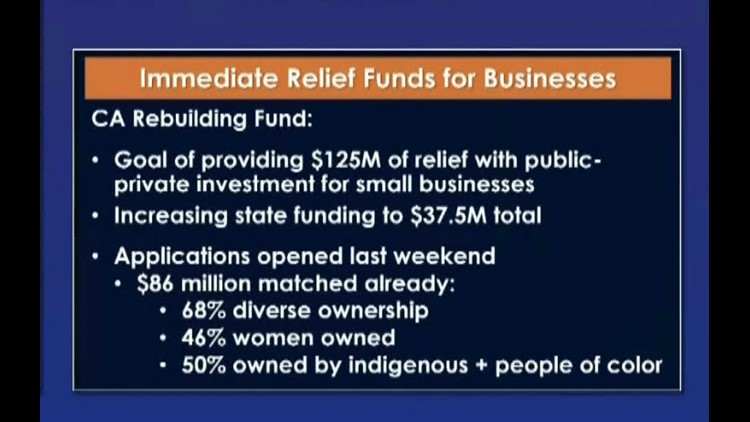

SAN DIEGO — Eligible California businesses impacted by COVID-19 are set to receive financial relief, including temporary tax relief. The assistance for the state’s businesses was announced during Governor Gavin Newsom’s press conference Monday afternoon.

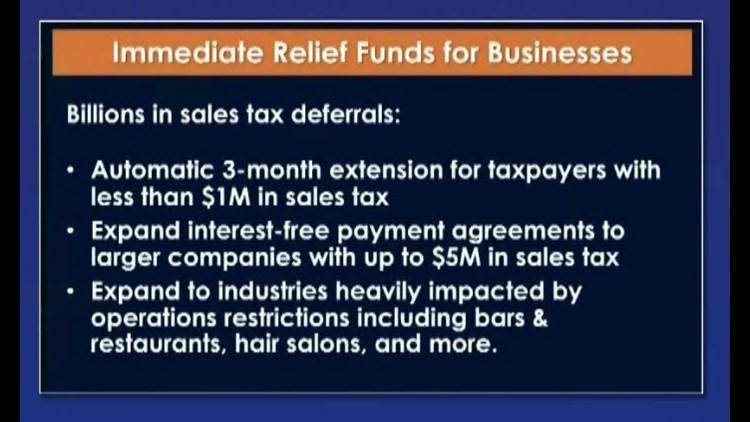

The temporary tax relief includes the following:

- Automatic three-month income tax extension for taxpayers filing less than $1 million in sales tax

- Extends the availability of existing interest and penalty-free payment agreements to companies with up to $5 million in taxable sales

- Provides expanded interest free payment options for larger businesses particularly affected by significant restrictions on operations based on COVID-19 transmissions

“California’s small businesses embody the best of the California Dream and we can’t let this pandemic take that away,” said Governor Newsom. “We have to lead with health to reopen our economy safely and sustainably while doing all we can to keep our small businesses afloat. With this financial assistance and tax relief, California is stepping up where the federal government isn’t.”

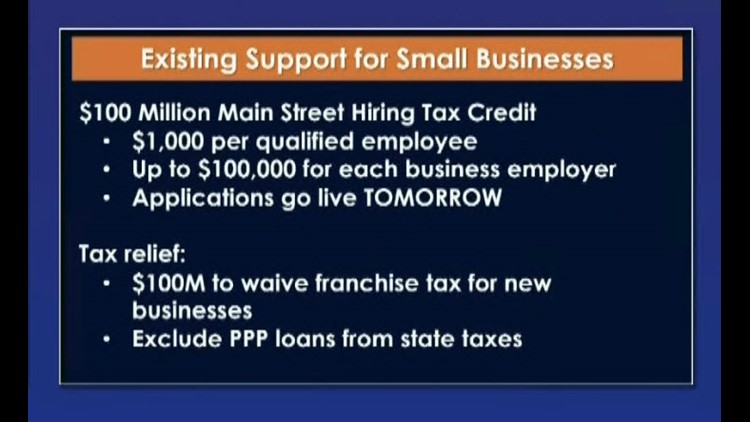

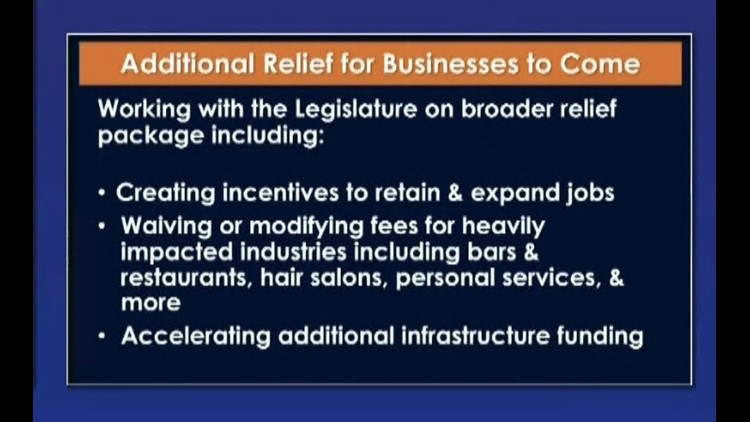

Newsom also addressed the state’s Main Street Hiring Tax Credit, which authorizes $100 million in hiring tax credit for qualified small businesses. The credit is equal to $1,000 per qualified employee, up to $100,000 for each small business employer. The application opens tomorrow, December 1.

“California’s small businesses continue to struggle as a result of COVID-19, and this latest round of action at the state level will help bridge the financial gaps that are vexing our state’s mom-and-pop business owners and nonprofits while we wait for congressional action, and as we prepare for additional legislative action at the start of the year,” said Senate President pro Tempore Toni G. Atkins (D-San Diego).

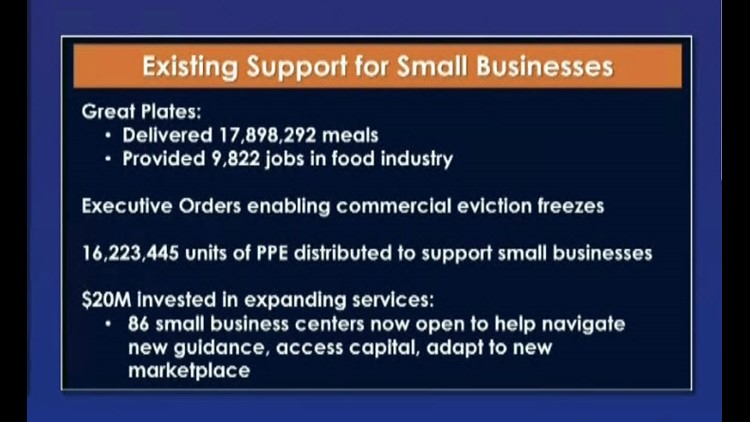

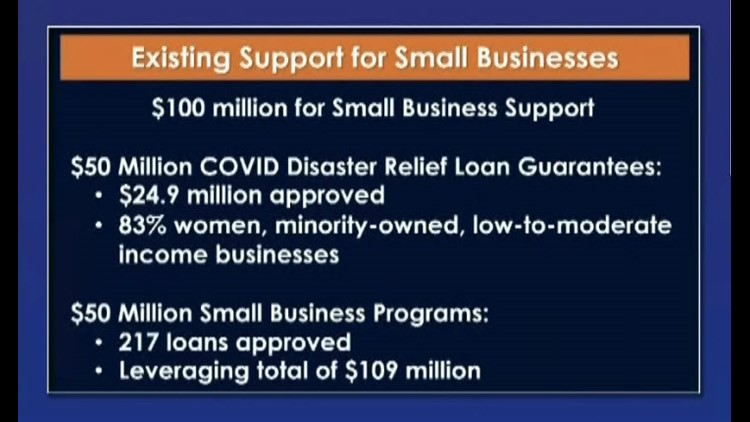

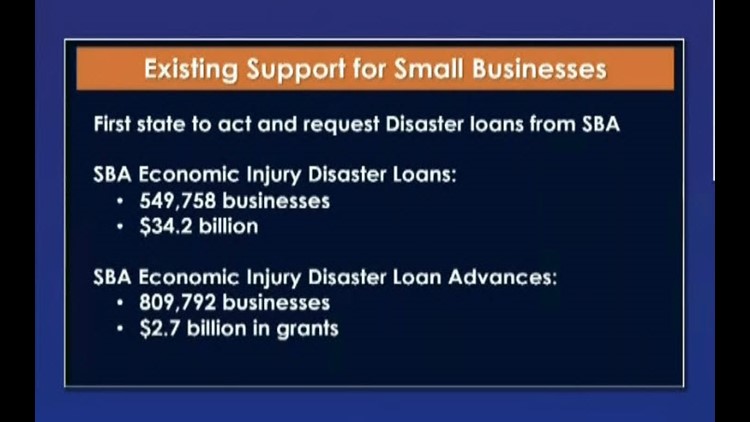

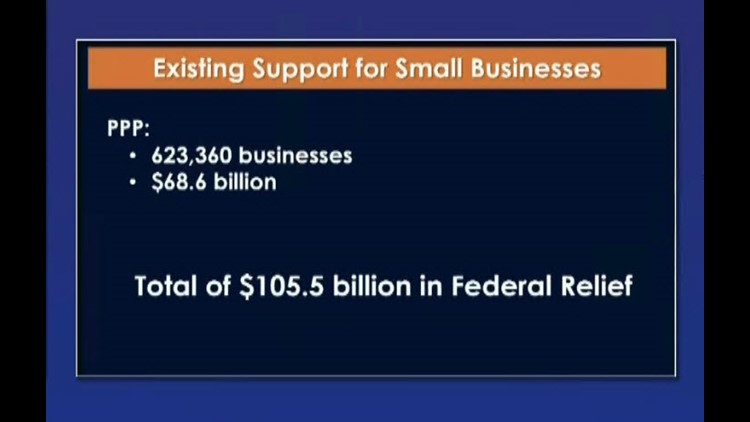

A full list of existing state support for businesses can be found on the ca.gov website.