CALIFORNIA, USA — There's fresh economic data that details a record avalanche of unemployment claims. But it's offering no signs of easing the rift between Democrats and Republicans over the need for new legislation financing infrastructure and other job-creation programs to help the economy and battle the coronavirus.

House Speaker Nancy Pelosi says the fact that 6.6 million people filed for jobless benefits last week makes congressional action more urgent. But Senate Majority Leader Mitch McConnell is not budging from his view that after Congress approved a massive $2.2 trillion package last week, lawmakers must focus on making sure that money is spent efficiently.

California's governor wants the state to let businesses keep up to $50,000 in sales taxes over the next year.

Gov. Gavin Newsom said Thursday the proposal would function as a state loan to small businesses, many of which have been forced to close during the COVID-19 outbreak.

The proposal would likely have a significant impact on the state's more than $200 billion state budget. Most of the state's revenue comes from sales and income taxes.

State officials have already delayed the income tax deadline by three months to July 15.

Oceanside moved toward implementing a $3 million small-business relief fund that will be used to issue micro-loans ranging from $10,000 to $20,000 to help local small businesses retain employees and stay afloat amid various federal, state and local public health restrictions.

The program will be open to businesses that can show they have sustained economic hardship due to COVID-19, have a city business license and have been in operation for at least six months.

The owners of the Anaheim Ducks NHL team -- Henry and Susan Samueli -- informed workers in Orange and San Diego counties, including part-time San Diego Gulls employees, that "all 2,100 part-time staff members will be paid for current or future rescheduled, postponed or canceled events through June 30." The Gulls are the minor league affiliate of the Ducks.

Chula Vista announced it would offer small business loans through San Diego's small-business relief fund.

Much like Oceanside's fund, loans ranging from $10,000 to $20,000 are available to businesses in the city.

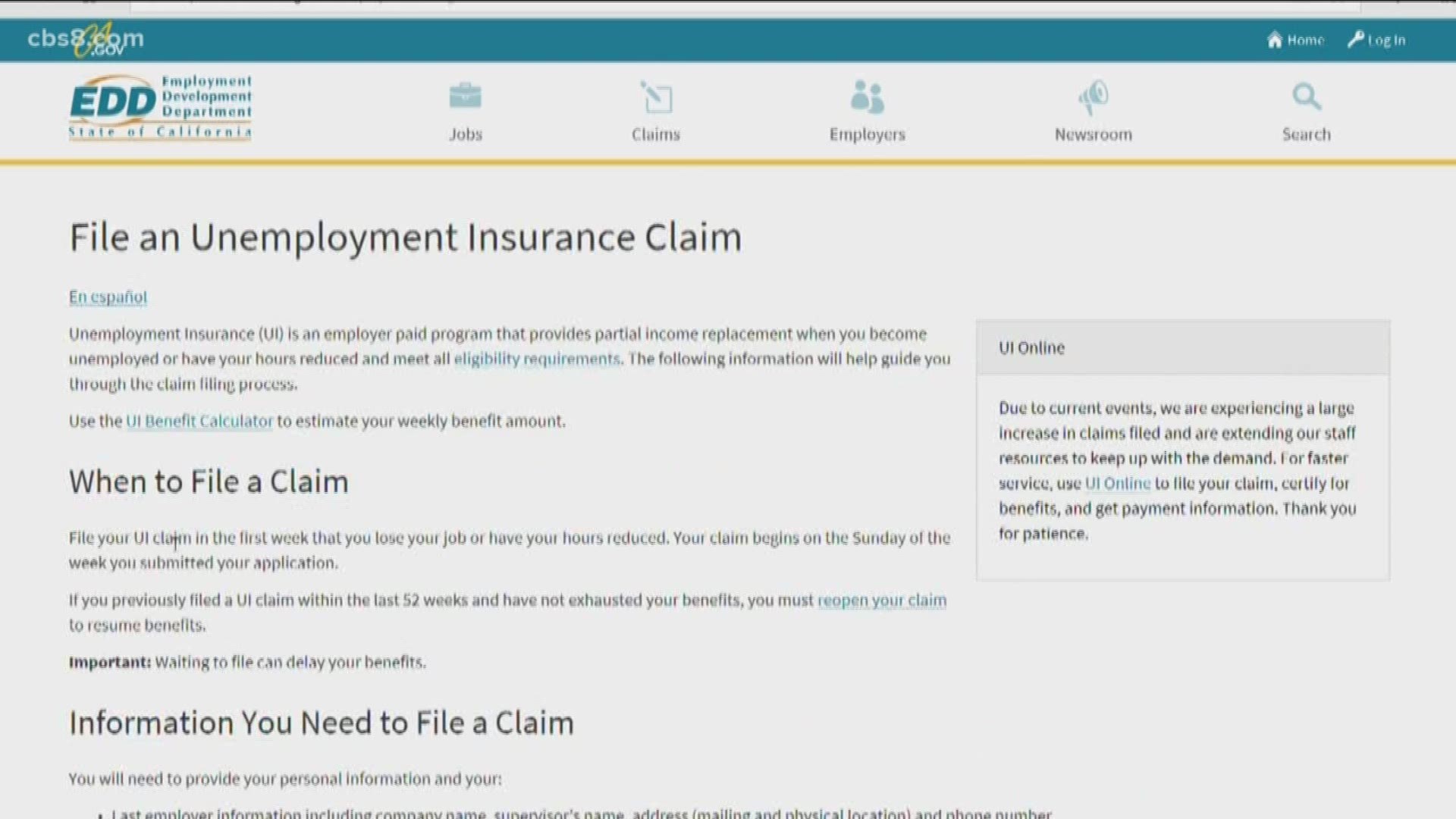

The coronavirus outbreak has triggered a stunning collapse in the U.S. workforce, with 10 million people losing their jobs in the past two weeks.

Meanwhile, the number of confirmed infections worldwide has hit 1 million, with more than 50,000 deaths, according to the tally kept by Johns Hopkins University.

Around the world, the economic damage from the crisis is piling up. And the competition for scarce ventilators, masks and other protective gear is fierce.