SAN DIEGO — It is tax season and Americans are inching closer to that filing deadline that many people look forward to and others dread. If you still haven't filed your taxes, you might be looking for a way to get them done for free. The good news is you can file taxes for free if you qualify by meeting certain income requirements of less than $58,000 or $73,000 annually.

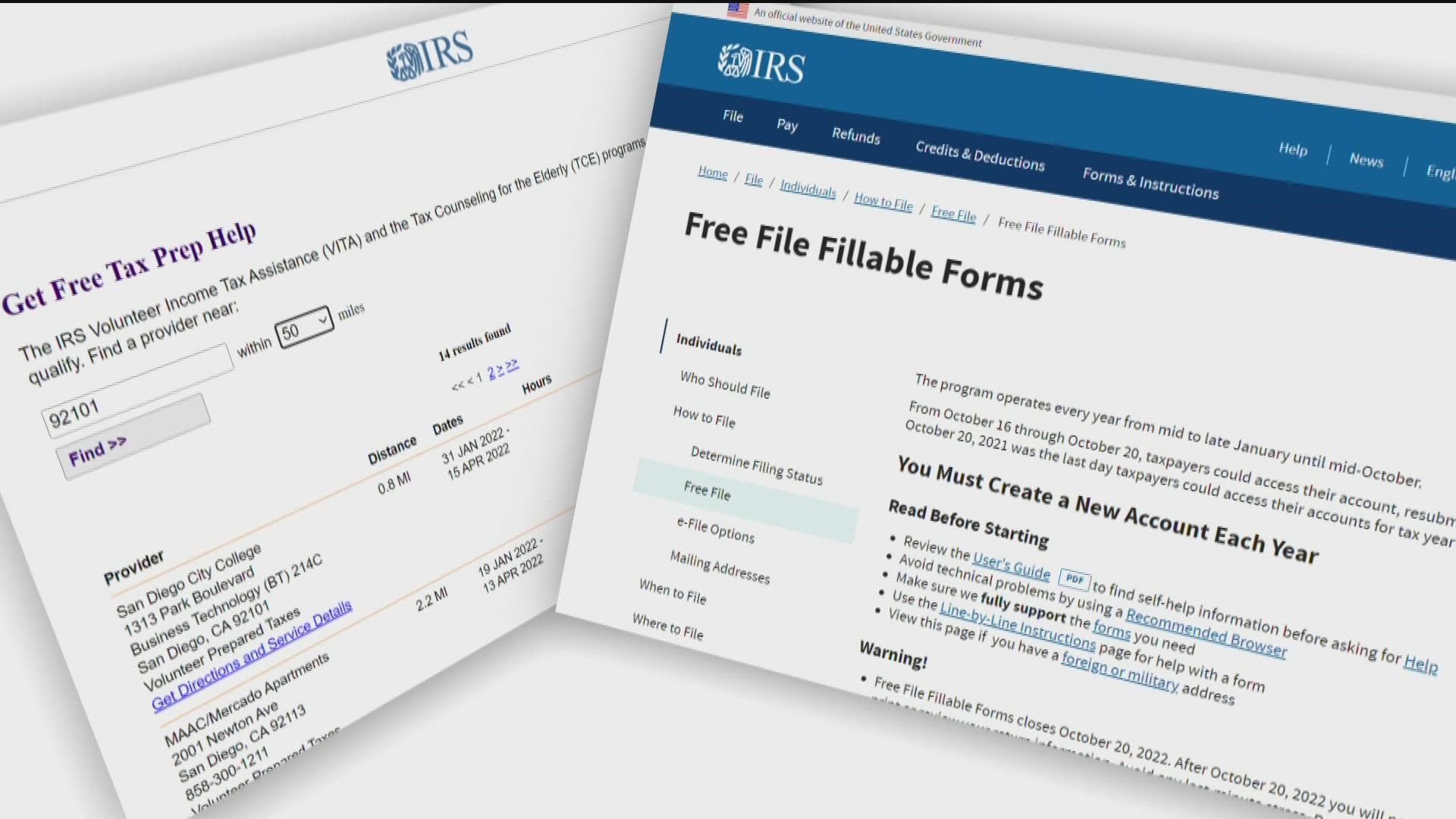

Raphael Tulino is a spokesperson with the IRS. He says, you can file for free a couple different ways. "Physically at Volunteer Income Tax Assistance, or VITA sites running throughout San Diego county through the deadline of April 18th. The other way is IRS Free File at IRS.gov.," said Tulino.

Tulino says the free VITA sites have an income max of $58,000 for the 2021 tax year and the IRS website has free online programs for filers making up to $73,000.

"Above and beyond the lower to moderate income levels for VITA and the free file program, you may be able to find other avenues for free out there depending on where you go," said Tulino.

How to file taxes for free

To file free online, Tulino says go to IRS.gov, click file and follow the prompts. There you might see some familiar tax filing companies.

"That is a partnership with the IRS and several software companies to provide their software for your use for free to file an income tax return."

Whether you do it at a vita site or online at IRS.gov, Tulino says you can trust their volunteers and software to do the hard work for you. “(They file) on your behalf, choosing direct deposit, doing an e-file return for you, alerting you to all the different credits available for low to moderate income tax payers. Along the same lines is the same thing for free file, however the income stipulation is $73,000 or less," said Tulino.

That's not all, Dr Alexis Avina with the United Way of San Diego says they're also giving free tax help on Saturday, April 2 because this year Dr. Avina says there are a lot of credits and a lot of need. "Many of them (filers) are not aware that they would qualify for this service," said Avina.

If you’re still looking for a place to get free tax help, Avina says just call 211. She offers, “All they need to do is share that they're interested in the free tax services, ask for an appointment. And the second way is to go to MyFreeTaxes.org."

Zip Recruiter says the average salary in San Diego is about $68,000 a year. So if you don't qualify for one program, you might qualify to file for free on the IRS website if you make less than $73,000 a year.

Tulino says you may be able to find some resources for free or reduced tax prep after if you make more than $73,000 but most offers and programs cap the free filing at low to moderate income requirements.

WATCH RELATED: Here's what you need to know about the Child Tax Credit for your taxes (Feb. 2022).