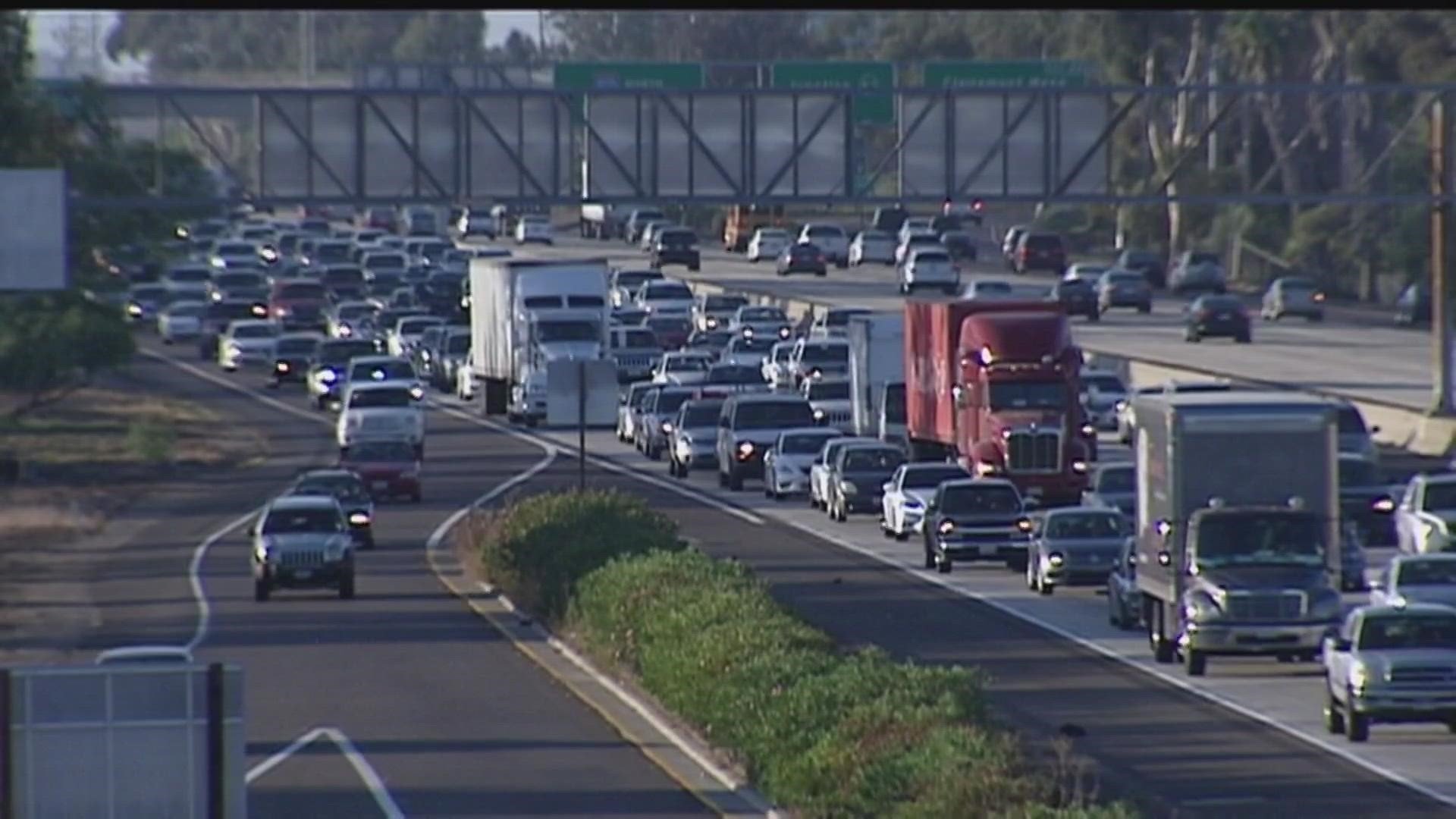

SAN DIEGO — Drivers in San Diego can expect to pay more for their car insurance in 2023 compared to last year.

A new report finds that our increase will be steeper than any other city in California.

San Diego's projected increase in car insurance is one of the highest in the nation, just behind Phoenix and Orlando. but there are ways to help lower your rates.

"The cost of insurance has definitely gone up," said Ben Huggins, owner of Everyday Insurance Services in Hillcrest.

It is on track to go up even more, according to a new report by Bankrate, which finds that auto insurance rates in San Diego are expected to rise about 15 percent this year compared to last, bringing annual premiums to an average of $2,270.

Huggins said that inflation has impacted the insurance industry like it has other sectors, and that - as more drivers are hitting the road as the pandemic wanes - they're driving more recklessly.

"The accidents are way high now and you're seeing an increase in the cost of parts, parts are harder to get, increase in the cost of body shop work, just all across the board," Huggins added.

That means it costs more to pay for claims, driving up premiums.

Also, California's Department of Insurance, which had frozen rate increases during the early years of the pandemic, are now beginning to allow insurance companies to raise their prices again.

"Because we live in San Diego, everything is going up," said South Bay resident Trina Nouvong. "I feel like this was bound to happen, unfortunately."

A teacher in Pacific Beach, Nouvong commutes about 60 miles round trip every day. She's resigned to having to shell out more to keep her insurance.

"As a commuter, what other choice do I have?" she added.

There are ways, though, to curb your costs when it comes to insurance rates.

Your daily mileage is the biggest 'driver' of your premiums, according to Grant Moseley, insurance director of Utopia in Kearny Mesa.

"So make sure your mileage is accurate and as low as possible," Moseley told CBS 8. "The more you drive, the more they're going to charge."

Moseley also said your collision deductible increases rates more than your comprehensive deductible.

"So I recommend carrying a lower comprehensive deductible and a higher collision," he added. "That will get you a better price."

And you're thinking of ditching your current provider, "make sure you got something in place before you cancel your existing policy," Huggins advised.

WATCH RELATED: Your Money: Inflation spike in car insurance rates (March 2022).