SAN DIEGO — According to the U.S. Bureau of Labor Statistics, San Diego households spent an average of $86,299 per year in 2021 and 2022, which is higher than anywhere in the U.S.

The study shows San Diegans are spending most of their money on housing, transportation, and food.

And now that the holiday shopping season is here, financial experts are warning against falling into the debt trap.

"53% of the population this holiday season will use credit cards for credit card protection and because they simply don’t have the cash to spend," said Leslie Tayne, New York financial attorney who has practiced debt relief for more than 20 years.

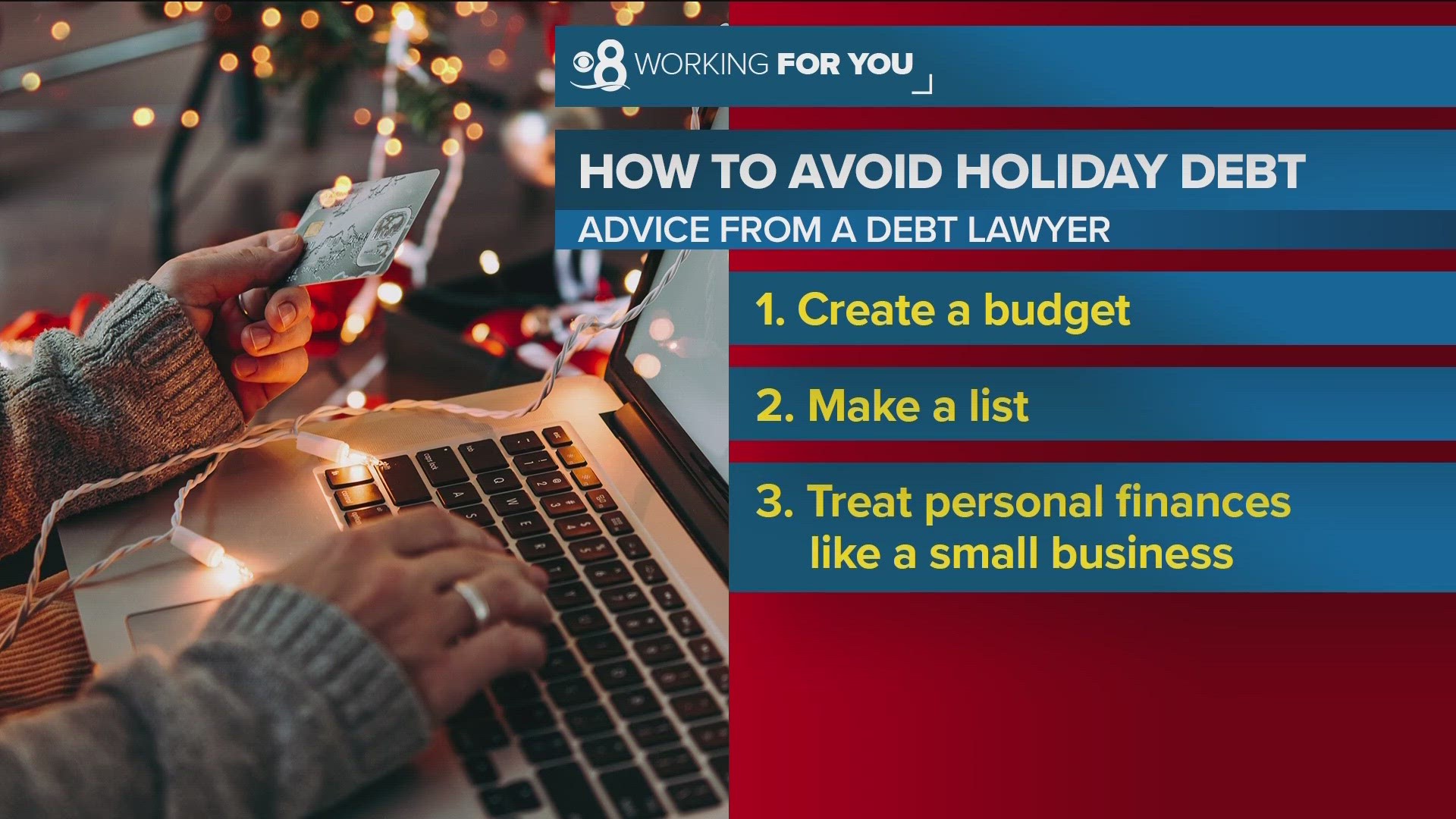

She broke down how to avoid holiday debt into the following steps:

1. Create a budget

2. Make a shopping list and stick to that list

3. Treat your personal finances as if you are running a small business

"Your personal finances is really a business. Money has to go in and come out and managing that with a business mindset, you can step back from emotional purchases and understand your wants versus needs," said Tayne.

Shoppers still plan to spend on average more than $1,600 this holiday season - that's 14% more than last year.

Tayne recommends being realistic about what you can afford, having money conversations with family and make a credit card payment plan.

Watch Related: The real cost of living in California (Nov 30, 2023)