EL CAJON, Calif. — A Dehesa couple is fired up, after getting an $8,000 bill for their homeowner's insurance this year.

The Olson family has lived in Dehesa Valley for decades, they've escaped fires and understand living in a fire zone comes with a cost but their latest homeowner's insurance bill from Traveler's is something they've never expected.

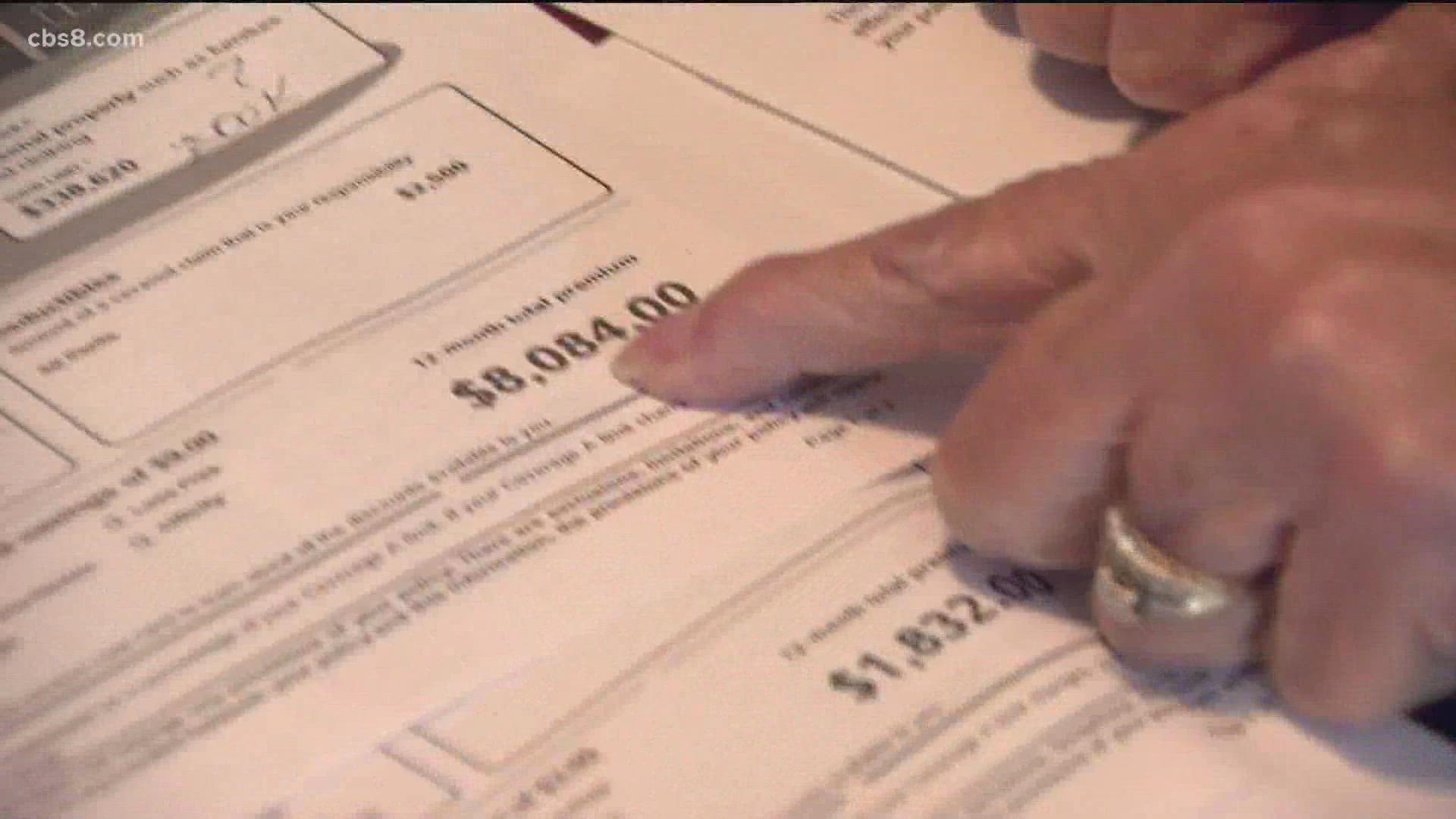

“I about fell on the floor. It went from $1,832 to $8,084,” said Karen Olson.

She thought there must be a mistake.

“I immediately called them [Traveler’s] and I said, 'I think someone made a typing error or pushed the wrong for button' and they said, ‘we agree let me check into that.’ They came back and said, ‘nope that is correct,’” said Olson.

Her husband Gary can't make sense of it either.

“We have two condos in town that are not in fire zones and in El Cajon and they went up 300%. It seems like they want us to cancel,” said Olson.

They’ve also taken fire mitigation measures on their property to help keep the rates down in a fire zone.

“We have a cement tile roof, and pruned the trees,” said Gary.

There’s a fire hydrant about 25 yards from their driveway.

CBS 8 reached out to Traveler’s who e-mailed a statement:

"We recently updated our homeowners product to be more tailored to each customer, which may result in rate increases based on a variety of risk-related reasons. These adjustments help to balance our risk exposure."

Statewide, rates have gone up for many reasons; fires, material costs, supply chain, even insurance companies are dropping customers and some customers are canceling their policy.

The Olson's say they checked with their neighbors who also have Traveler's and one bill went up to $2,800 and they had more coverage.

“Travelers will not get another penny from me. I have been shopping, we do have options. It's still going to be expensive, $3,400,” said Karen.

The Olson's filed a complaint with the California Department of Insurance who declined to comment about their case but says the Commissioner is encouraging more competition to drive prices down.

“I'm just at a loss. I just want answers. I cannot believe a company can treat people like this and they are getting away this,” said Karen.

A spokesperson for Traveler's says they've responded to Olson's complaint filed with the California Department of Insurance.

After we followed up with CDI, the Olson’s say they did receive a call from CDI who says they are looking into this matter.

CDI sent this statement:

The Department of Insurance is a resource for any homeowner or business with questions about their insurance coverage. We can make sure that the insurance company followed the law and inform consumers about what options they have.

Competition is what is needed to drive down prices. Commissioner Lara is taking action to protect homeowners and businesses in the face of wildfires and increase competition to better serve consumers. Because of his actions more insurance companies are offering discounts than ever before to homeowners who make their homes safer. Visit the link on our webpage: Safer from Wildfires (ca.gov)

Department staff will be contacting this consumer, and we urge any homeowner with questions to view the resources on our website at Home/Residential Insurance (ca.gov), call 800-927-4357 to speak with our insurance experts, or use our online chat feature at www.insurance.ca.gov.

WATCH RELATED: CBS 8 sits down with SDG&E to discuss rising costs, frustrated customers | Part 2 (February 2022)