SAN DIEGO — Being single and living with a significant other both have their perks, but when it comes to buying a home couples seem to have an advantage.

A new study reveals it could take a lifetime for singles in San Diego to save a down payment and buy a home.

Five decades

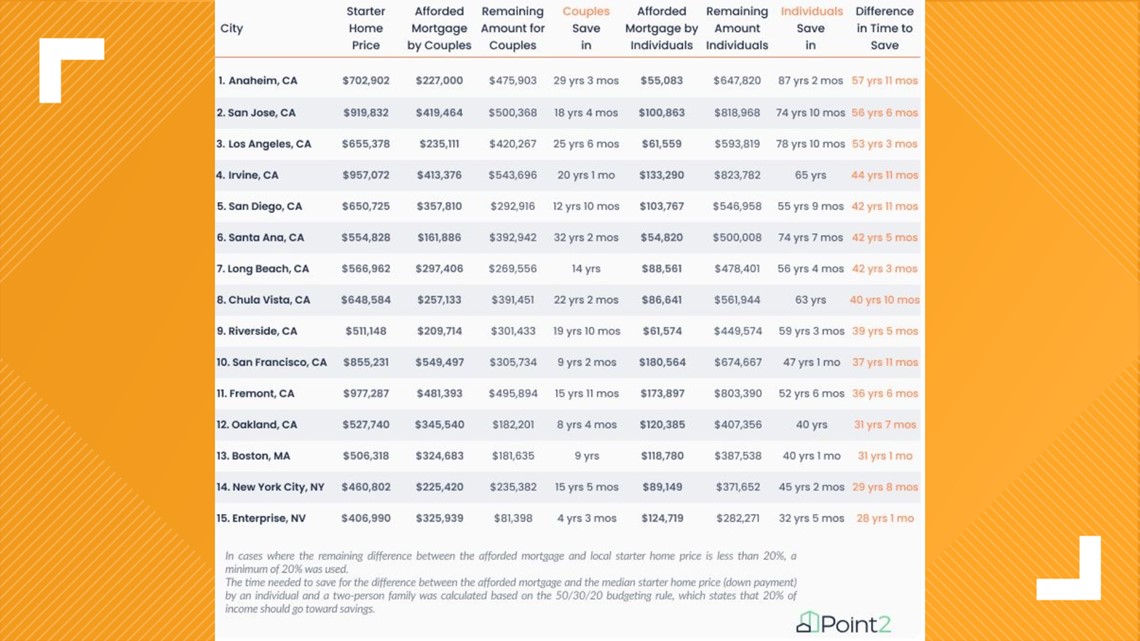

According to a study by Point2Homes, it could take up to 55 years for a single person in San Diego to set aside 20% of the $49,000 median income for a starter home down payment.

San Diego

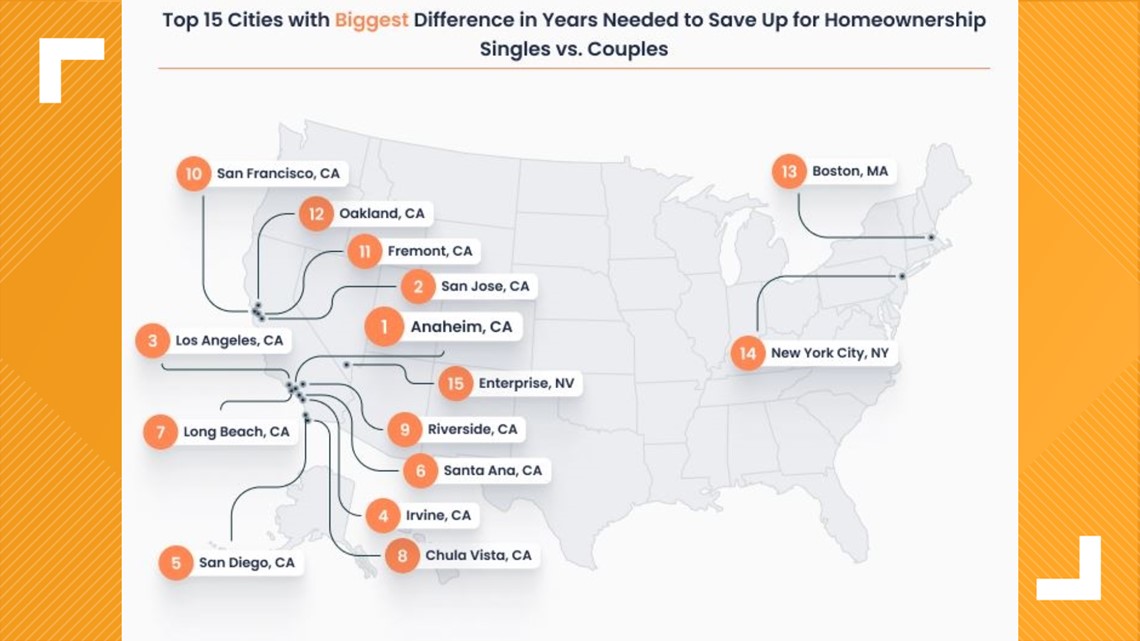

San Diego was ranked fifth on the study’s list of Top 15 cities with the biggest difference in years to save up for homeownership for singles compared to couples.

For singles earning a median income of $49,000, it will take 55 years and 9 months to save up to buy a $650,725 starter home, according to the study.

In comparison, for couples earning a median combined income of $114,363, the study says it will take 12 years and 10 months.

Chula Vista

Chula Vista was ranked eighth on the study’s list of Top 15 cities with the biggest difference in years to save up for homeownership for singles compared to couples.

For singles earning a median income of $44,606, it will take 63 years to save up and buy a $648,584 starter home, according to the study.

In comparison, for couples earning a median combined income of $88,431, the study says it will take 22 years and 2 months.

Methodology

According to the study,

- To compare the 100 U.S. cities, researchers used the 50/30/20 rule (where 20% of the income should go towards savings) to calculate and compare the years required to save up for a down payment by individuals and couples.

- Researchers calculated the mortgage amount that an individual and a couple would qualify for based on their incomes, considering that a monthly mortgage payment doesn't exceed 30% of the median income.

- The study also considered the 6.6%, 30-year fixed-rate mortgage as per FRED.

- The study calculated the difference between the maximum mortgage and local starter home price down payment needed to purchase a home. The default used in the study was a minimum 20% of the starter home price.

WATCH RELATED: San Diego sees significant increase in home sales in February 2024